If money is sent to the wrong person, you will not get it back.

Without a middleman, paying someone with cryptocurrency is risky. The value of crypto currencies changes daily because of volatility which makes cryptocurrency unreliable as a currency to transact goods and services. If there is a run on a particular coin-based exchange, there isn’t a government entity that will step in to help consumers get their money back. Unlike the US dollar, cyptocurrency is not backed by the federal reserve and does not have a safety net to ensure that its value is stable. My Mother Was 73 When She First Saw Her Father But the value of cryptocurrency is undermined by its instability, warned FTC experts. Dogecoin which was created as a joke from an online meme, clocked in at $4 million. High value software-based cryptocurrencies are being developed every day and birthing largescale financial systems of their own.įor example, Bitcoin and Ether are now worth around $35 billion and $17 billion respectively. “I can get cryptocurrency online or through an ATM and send it to XYZ and don’t have to open an account or store it somewhere,” explained Kwok. They can send cryptocurrency directly to a person to get paid or to receive payment. This peer-to-peer system allows individuals to choose how they want to deal with a transaction. People can interact without having to set up accounts or share their identity. One of the hallmarks of cryptocurrency is that there typically is no middleman in the transaction. They are “unique to a particular set of people, for example, in Puerto Rico where people live off the grid as an alternate community.” Crypto Has No Middleman One exception is Bitcoin ATMs which provide a physical card of bitcoin holdings. It’s a digital currency, “used primarily electronically and is analogous to other currencies like airline miles or rewards points on credit cards.” She explained that cryptocurrency, which was created in 2009, is not a physical token. Kwok is the Assistant Director of Division of Litigation Technology and Analysis for the FTC‘s Bureau of Consumer Protection.

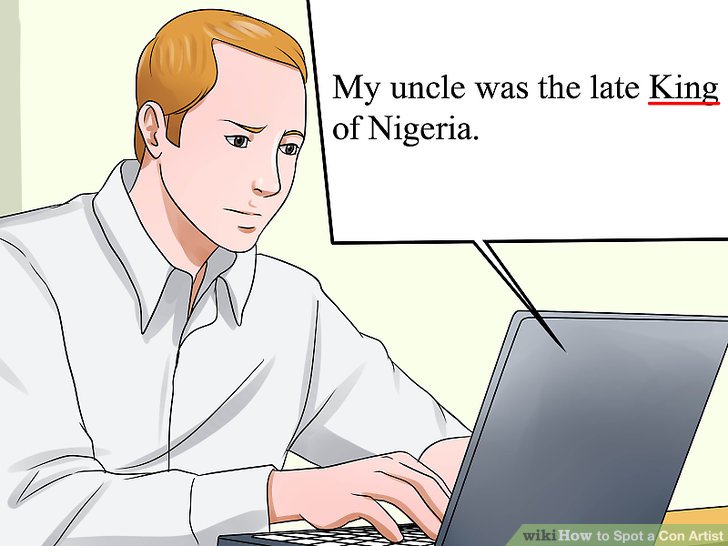

What is Cryptocurrency?Īccording to the FTC’s Elizabeth Kwok, cryptocurrency is a digital asset that can be transmitted online. Rosario Mendez, from FTC’s Bureau of Consumer Protection, said it was time that people identified scams to avoid losing money. In a briefing with Ethnic Media Services on September 9, the FTC warned that scammers were coopting digital-based currencies like Bitcoin, Tether, and Ether to swindle people. More than 46,000 people lost over $1 billion in crypto to ‘get rich quick’ schemes reported the Federal Trade Commission ( FTC), as cryptocurrency fast becomes a popular way to scam money from people. INALIENABLE: REFLECTIONS ON INDEPENDENCE & BELONGING.Voices Column: Desi Roots, Global Wings.

0 kommentar(er)

0 kommentar(er)